Proportional Payee Amortization

Accounting for costs in the cloud can be difficult, especially when there are variable or lumped costs. Accounting departments need a better way to account for large upfront costs associated with Reserved Instances (RIs), especially when the savings benefits can be shared by different departments within an enterprise.Use Case

A challenging situation is when an accounting department needs to amortize RI costs to appropriate teams within the organization. Use of RIs requires proportional amortization allocated based on usage hours. This means mapping a small piece of the upfront RI payment to each hour of usage for the RI. This is implemented using tags that can be assigned to resources and tied back to RI usage. The result is in the expected increase in cost when looking at numbers that have been processed.

Example: A payer account has purchased 1,000 RIs with an upfront amortized fee of $1000 per month. There are 500 instances (running 24×7) for the month across all the consolidated billing family. One payee is using 100 instances (running 24×7) for the month. That payee would be allocated $200 per month of RI upfront fees:$1000 / 500 total instances * 100 instances used = $200

Configuration

- Go to the Configure Custom Cost screen, located at Cost/AWS Partner Tools/Configure/Configure Custom Cost.

- Select the following Custom Cost parameters:

Cost Type

Blended

EC2 Reserved Instance Amortization

On-demand Amortization Cap

RI Unsharing

Disabled

Enforce EC2 Standard Reserved Instance Volume Discounts on Account Families

Disabled

Uncompress Pricing Tiers

Disabled

- Click Save.

You can visit the Custom Cost Configuration page for more information on the various available customizations.

- Reload any historical billing months that you want to modify with Proportional Payee Amortization.

Review Results

These proportionally and hourly amortized costs can be seen by using CloudCheckr's Advanced Grouping cost report, where you can pivot your account's data to quickly reflect the true cost incurred by various business units' RI spend across your organization.

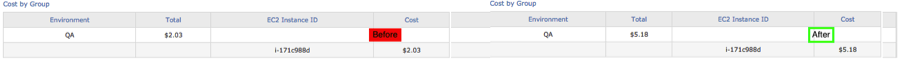

Here is an Advanced Grouping report that displays a single EC2 instance with the tag of QA, highlighting its original usage from AWS (red), and its original usage with proportionally correct amortization added to it (green).

You can perform a similar search by using Advanced Grouping to search for EC2 instance costs that are grouped by a specific tag.

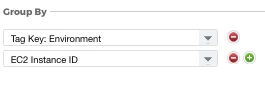

Here's how our example was created:

- Navigate to Advanced Grouping and create a search for

Tag Key: EnvironmentandEC2 Instance ID.

- Choose Cost Type: List. Whenever you want to view costs that have Proportional Payee Amortization applied to them, you will need to search using List Cost. List Cost is simply the legacy name for Custom Cost, which you can think of as a fully customizable cost type that you can modify to suit your needs. In this example, we are modifying Custom Cost to have Proportional Payee Amortization on it.

- Make sure to choose a date range. You don't need to select any other filters for this example (because by choosing to Group By EC2 Instance ID in Step 1 above, we are by definition limiting our results to only ones with EC2 instances). For your own searches, you can of course filter however you'd like, e.g. by Region, Account, etc. Click the blue Filter button to get your results.

- You can compare your results to the non-amortized amounts by doing an identical search except using Cost Type: Blended (i.e. the default, unmodified cost data direct from AWS).